Insurity Predict

Forecast the future and react in real time with AI-powered predictive models

In today’s competitive landscape, your predictive power is an asset and a differentiator. Put the P&C insurance industry’s most respected predictive analytics and modeling platform to work for you while leveraging the predictive power of the proprietary $109B Valen Data Consortium. Gain a deeper understanding of your portfolio and underwriting decisions to grow your bottom line, proactively manage your business, and discover new market opportunities.

Industry Average Growth

Drive growth with proven predictive insurance analytics; our customers see 3x the industry average growth.

Loss Ratio Improvement

Improve profitability and lower your cost of claims with predictive modeling; our customers see 3-10% better loss ratios.

Faster Speed to Quote

Make better decisions when quoting or renewing business with robust, industry-leading predictive models.

Increase in Predictive Power

Add AI-powered predictive analytics to your insurance underwriting and pricing models with the $109B Valen Data Consortium.

What’s it like to use Insurity Predict?

UBIC, a workers’ comp carrier, details its experience of transitioning to a predictive data model. Not only does Insurity Predict allow UBIC to process a significantly higher volume of business, but it provides their underwriters with an even greater level of trusted insight into more complex risks.

Why Insurity Predict?

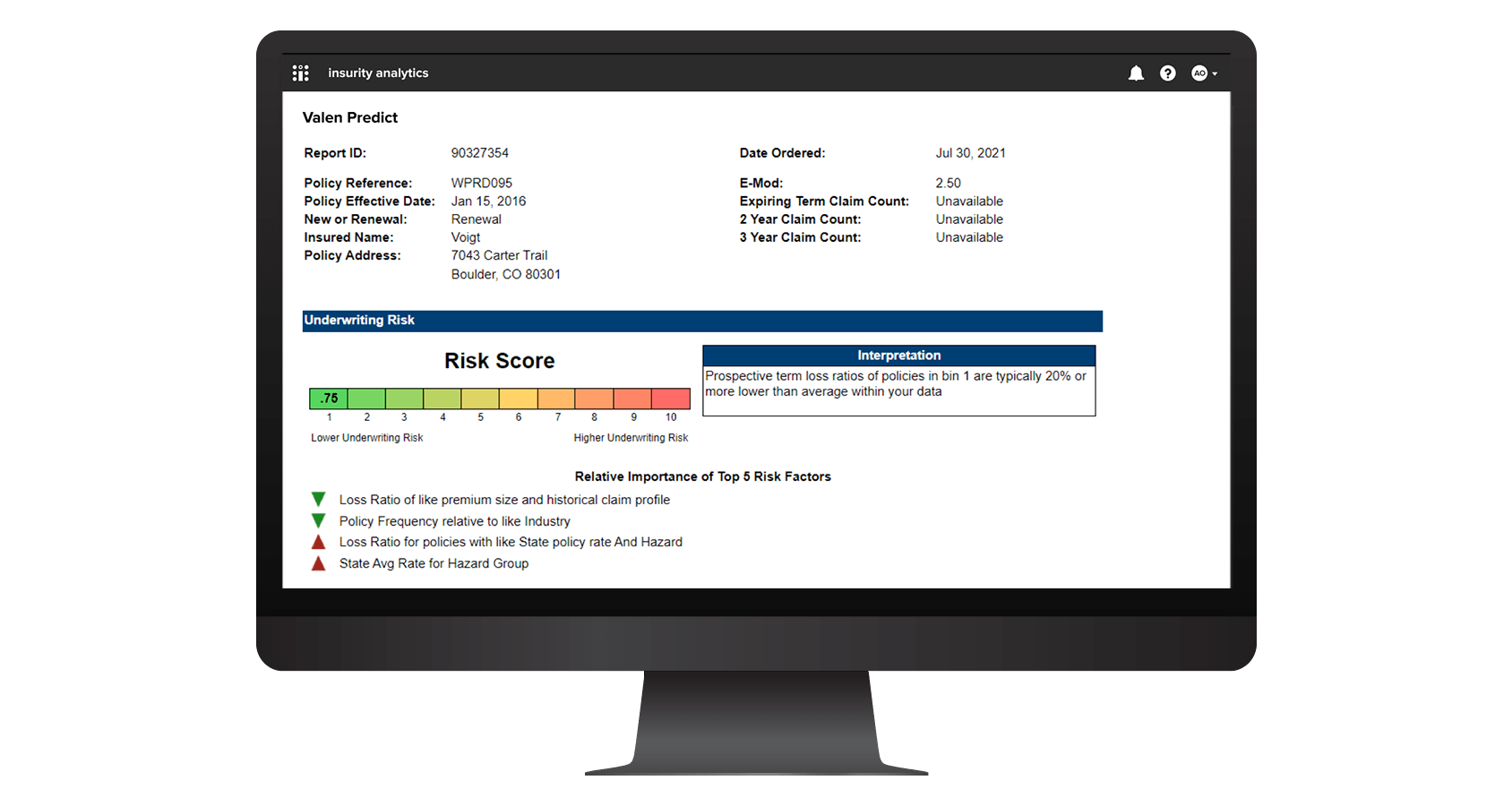

Real-time predictive insights

Get real-time, data-driven insights when quoting or renewing business with calibrated predictive analytics models from the Valen Data Consortium. Our models use advanced AI and machine learning techniques to enable automation and provide superior decision support. Whatever your business goals may be, we’ll generate a dataset and model to achieve your objectives with an average build and deployment time of only 12-18 weeks for calibrated models and 4-6 weeks for production-ready models.

Modernize your underwriting

Improve underwriting efficiency and accelerate growth with straight-through processing workflows that are custom designed to help achieve your business automation goals. Our predictive analytics solution delivers strategy, design, implementation, and measurement through a proven framework, enabling your underwriters to focus on policies that require their expertise. Put data to work as a decision engine while gaining a partner that will monitor the performance of your workflows in real time.

Proactive management

Know underwriting performance in advance and gain actionable insights to proactively manage your portfolio. Our proprietary underlying data model combines model predictions, actual underwriting decisions, and actual claims experience to show quantifiable results. Individual policy predictions are aggregated to show a portfolio view, leveraging predictions as leading performance indicators allow you to proactively optimize profitable segments and address problem areas in real time.

Expand your predictive power

Add unparalleled depth and breadth to your data while extending your predictive power with the Valen Data Consortium. Boasting $109 billion in premium across all standard P&C lines of business, it’s the largest proprietary database of policy, claims, billing, and submission data available. Insurity Predict enables you to increase model lift with predictive variables from the Valen Data Consortium and is built on robust, credible, and anonymized datasets to deliver superior ROI.

Resources

Insurity Analytics, Powered by AI-Driven Insights, Accelerates Data-Driven Decision Making for P&C Carriers

Insurity’s analytics solutions allow insurers to forecast the future and react in real time with AI-powered predictive models.

Insurity Predict Solution Overview

Drive long-term growth and deliver market-leading ROI with Insurity Predict.

Insurity Predict Case Study

Learn how experienced underwriters are leveraging Insurity Predict for more accurate pricing.

Insurity Predict includes Valen Analytics and is deployed on AWS.

Book a demo