Insurity Claims

Resolve claims faster and differentiate the policyholder experience

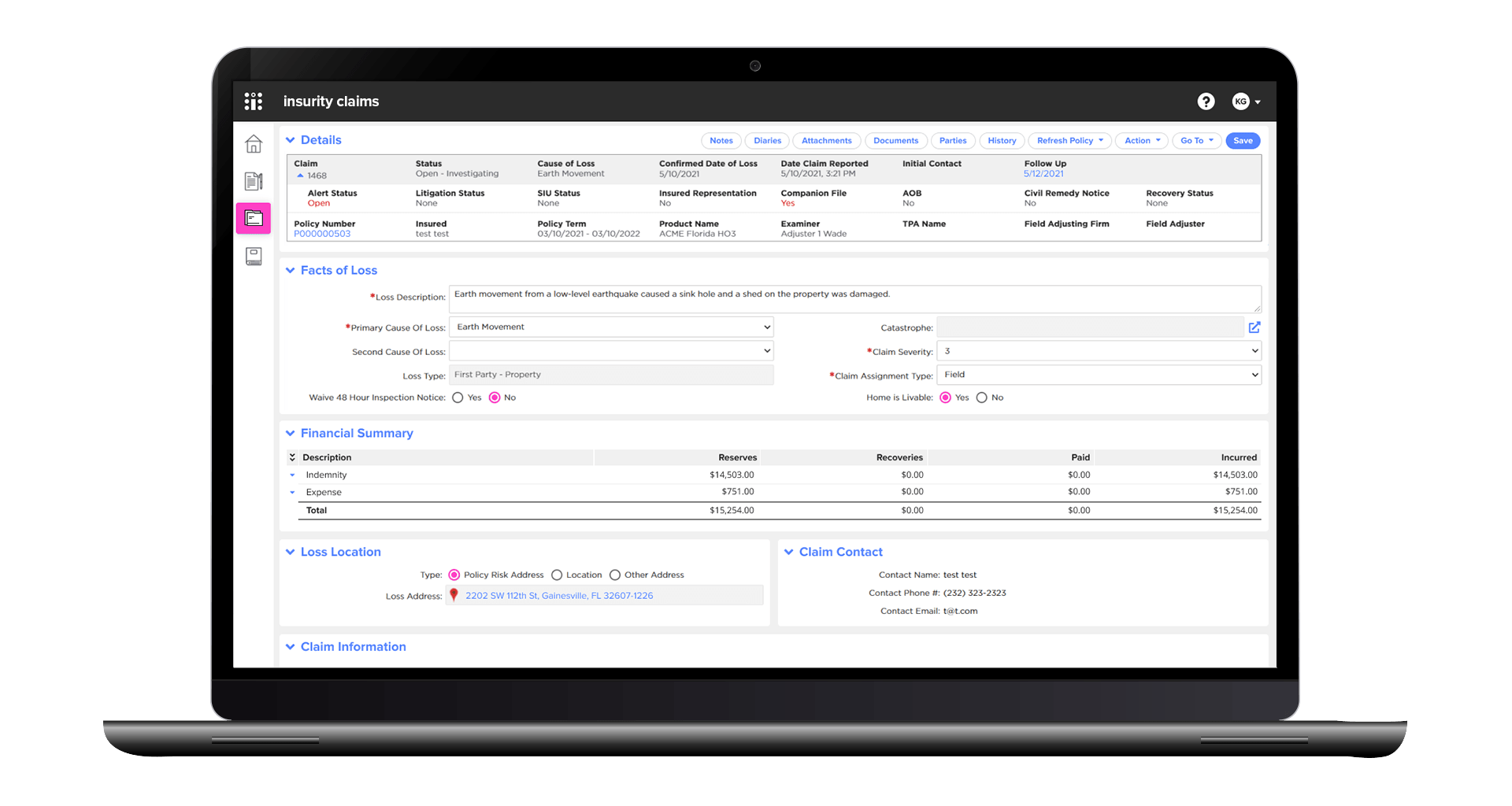

Speed up claims resolution and minimize leakage with a cloud-based, configurable platform that enhances efficiency, policyholder retention, and provides a seamless experience from first report of loss through settlement.

Embedded Analytics

Leverage advanced analytics integrated into the claims workflow to enhance decision-making and improve loss ratios.

Smart Configuration

Tailor your claims workflows easily with an intuitive, simple, and fast no-code toolset and flexible data fields.

Cloud-First Platform

Foster growth with a scalable, secure cloud intrastructure that ensures your system is always up-to-date and accessible.

Catastrophe Handling

Expedite claims resolution during catastrophic events with AI-enabled FNOL for 75% faster claim reporting times.

Why Insurity Claims?

Automate with analytics and AI

Streamline claims handling with predictive analytics embedded throughout and resolve claims quickly using AI-powered virtual assistance, improving speed and reducing costs.

Deliver better experiences

Offer exceptional service through self-service capabilities, fast digital payment options, and personalized interactions, enhancing satisfaction and retention.

Enhance claims accuracy

Minimize errors and enhance claims management with automated data capture and adjuster assignments, leading to increased accuracy and efficiency.

Understand performance

Convert claims data into actionable insights with advanced analytics and configurable dashboards to optimize performance, reduce risks, and lower costs.

Resources

Insurity Recognized as a Strong Performer in P&C Claims Management Systems Evaluation

Insurity’s inclusion in Forrester’s Wave report marks the progress its claims software has made in delivering new capabilities, service, and support mechanisms.

Insurity Claims Solution Overview

Accelerate the claims lifecycle and provide a seamless claims settlement experience with Insurity’s claims software.

Insurity + IBM: The Best Customer Experience in the Worst of Times

Learn how Insurity’s AI enables insurers to respond faster and more efficiently to policyholders’ claims following severe weather events.

Book a demo