Insurity Analytics

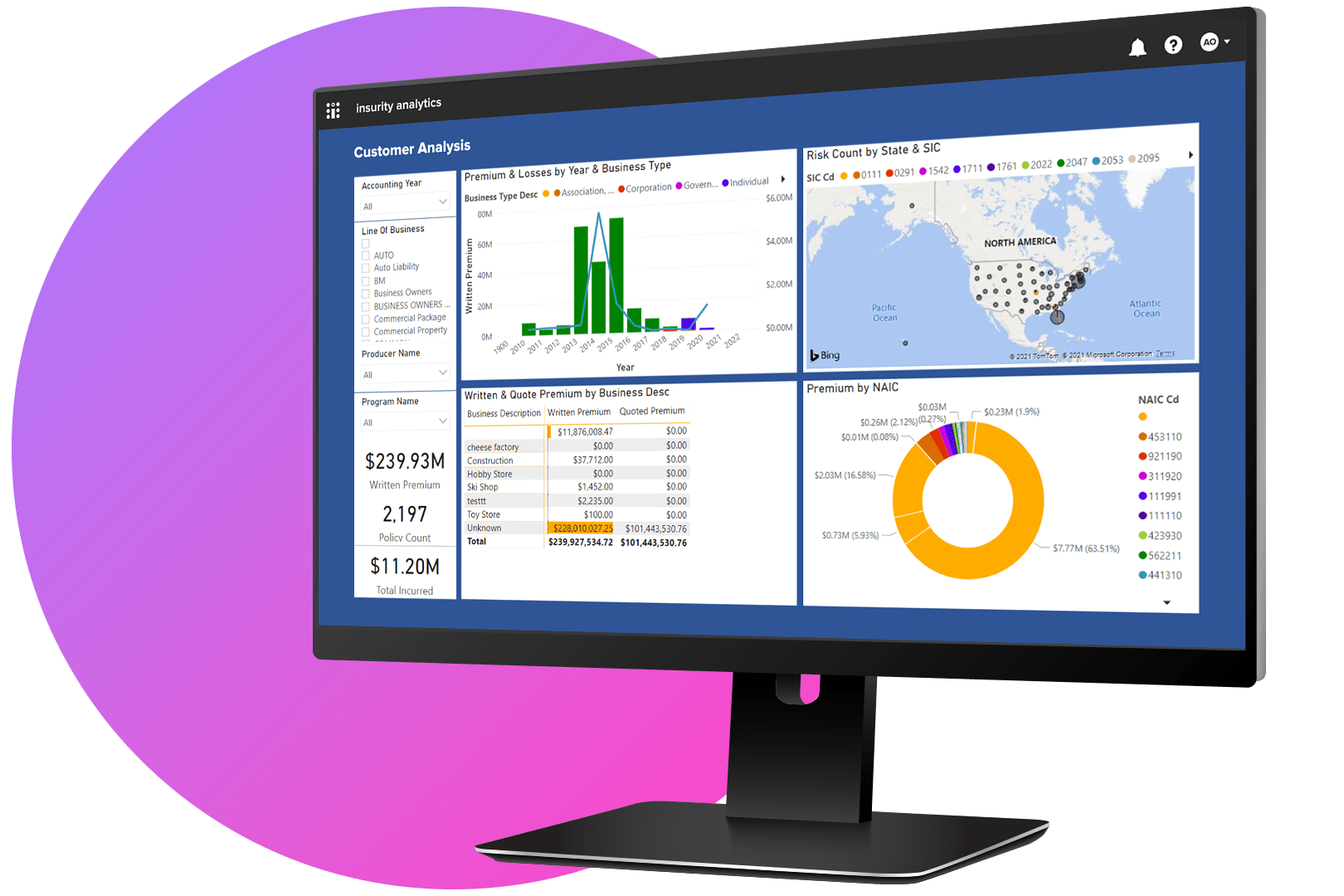

Drive growth and profitability by empowering your decision-makers with data-driven insights delivered in the right context, at the right time. Insurity Analytics is the only cloud-native, open data analytics platform in P&C insurance built on a proprietary Data Hub that leverages the $109B in premium Valen Data Consortium.

3x Industry Average Growth

Drive growth with predictive analytics that have enabled Insurity Analytics customers to experience 3x the industry average growth rate over the past 5 years.

3-10% Loss Ratio Improvement

Improve profitability and lower your cost of claims with 3-10% better loss ratios and 5% improvement in claims costs among customers compared to the industry average.

25-40% Faster Speed to Quote

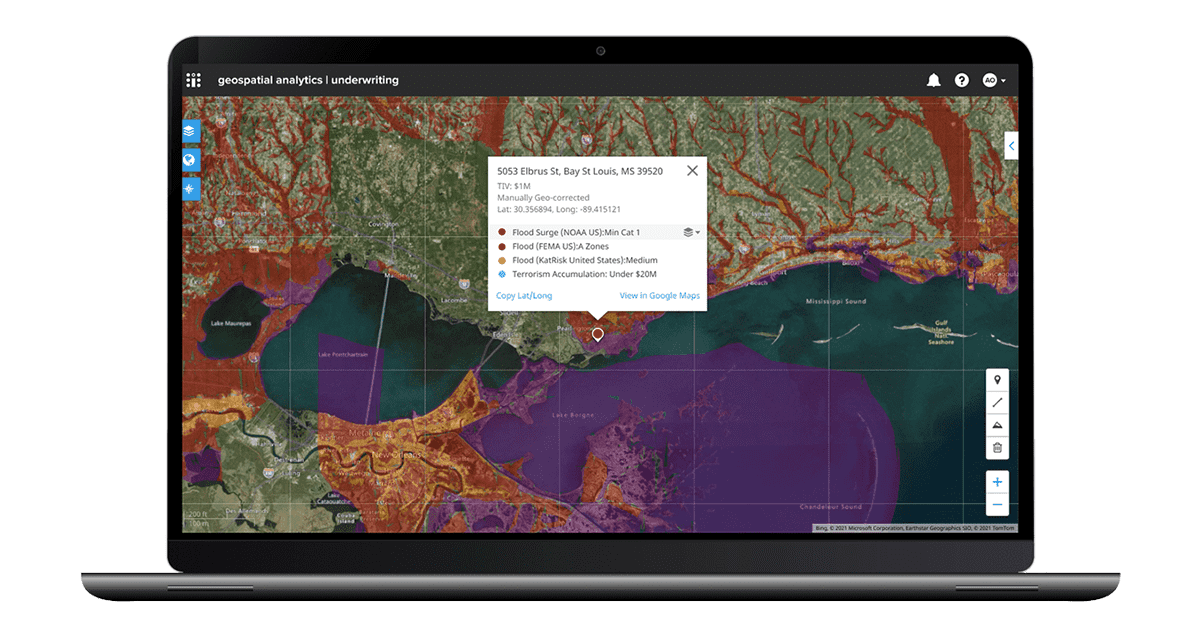

Increase speed to insight and drive growth with robust geospatial analytics, AI-powered predictive models, and the industry’s largest open network of data providers.

How does Insurity Analytics empower your underwriters to make data-driven decisions?

Learn how Insurity Analytics allows leading P&C insurers, including Frank Winston Crum Insurance, Markel, UBIC, and LUBA Casualty, to make faster, stronger decisions at the underwriting level, helping drive competitiveness, boost profitability, and create a data-first culture.

Our success stories

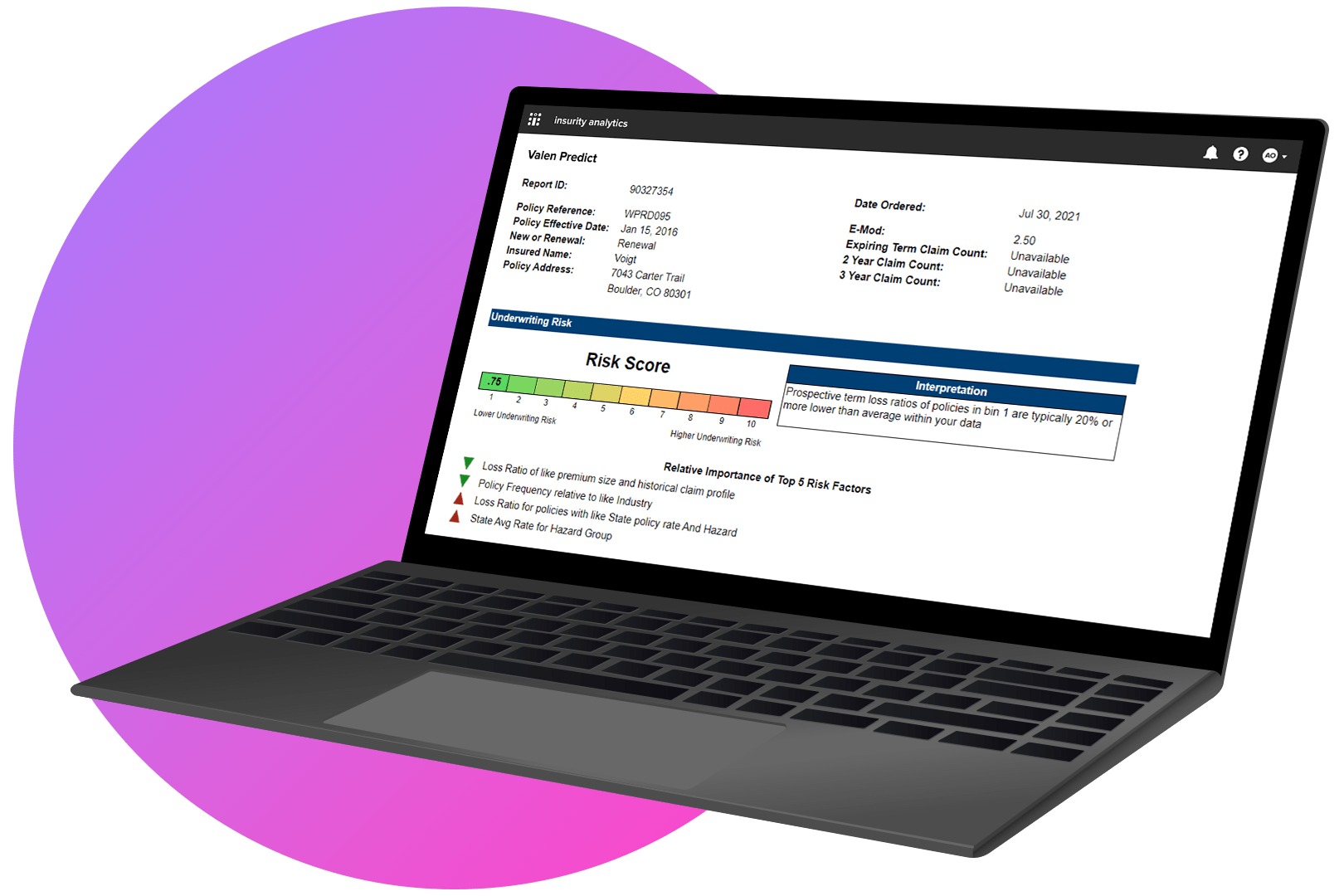

What’s It Like to Use Insurity Predict?

See how leveraging predictive analytics allows for one P&C insurer to take on more business without taking up more bandwidth.

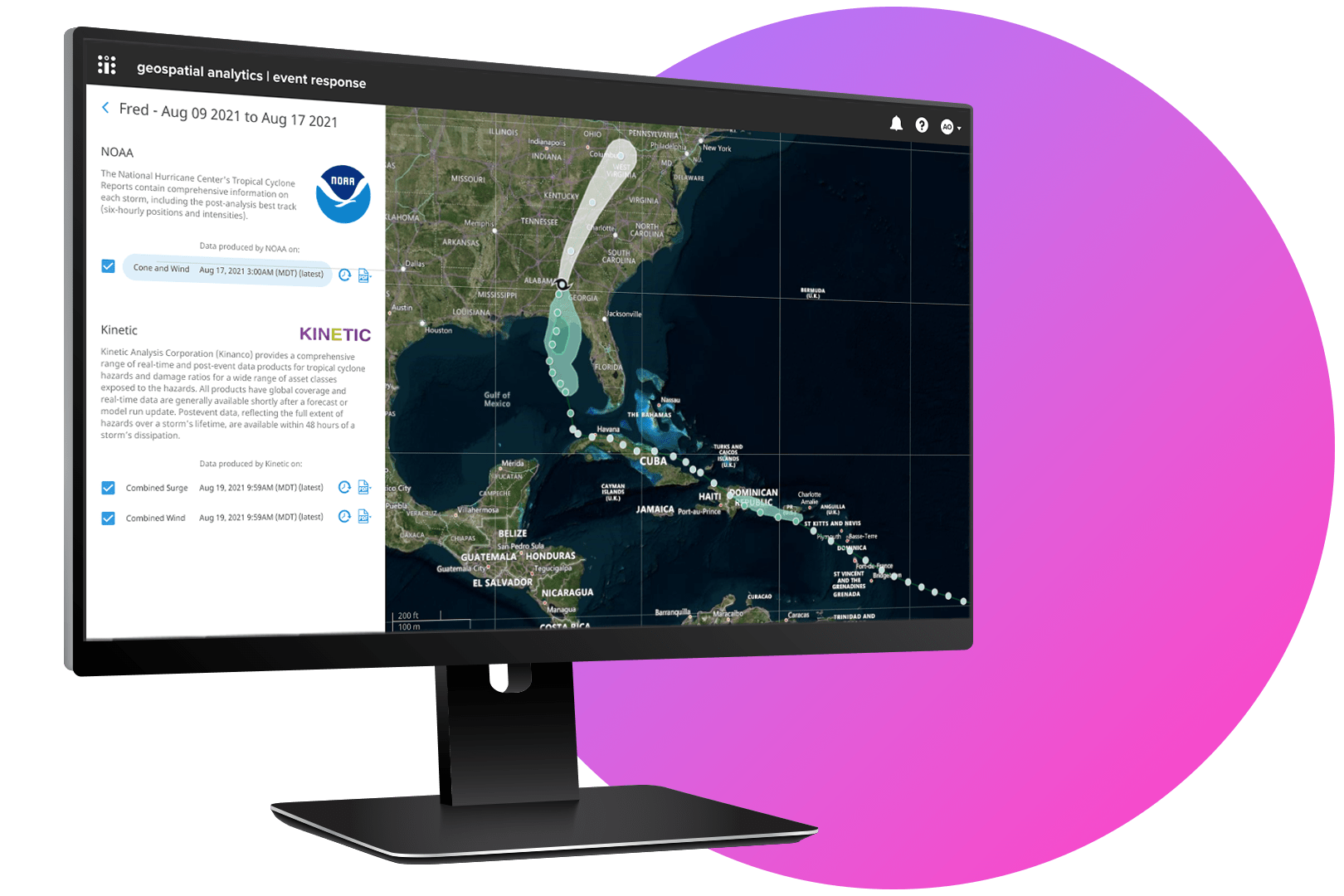

Insurity Event Response Guide: How to Automate Your Event Response

Employing proprietary and industry research, the guide identifies how insurers can dramatically reduce time spent on event response with intuitive, proactive data analysis.

Insurity Analytics, Powered by AI-Driven Insights, Accelerates Data-Driven Decision Making for P&C Carriers

Insurity’s analytics solutions allow insurers to forecast the future and react in real time with AI-powered predictive models.

What's in Insurity Analytics?

The Largest P&C Data Network with 50+ Third-Party Data Sources

Insurity Analytics includes Valen Analytics, SpatialKey, Maprisk, and DataHouse.

Book a demo