Insurity Data Depot

The P&C industry’s most modern, open, and cloud-native data platform

Deliver insights between systems and take control of your data strategy with a modern data platform powered by Snowflake. Insurity Data Depot accepts data from any policy, billing, claims, reinsurance, or MGA/TPA source applications to be your central source of truth. Drawing from the broadest and deepest data repositories in the industry, Data Depot delivers the most comprehensive reporting and analytic insights so you can make data-driven decisions throughout your organization.

Cloud Performance and Scalability

Gain unparalleled performance, consistency, and security with a modern data platform powered by Snowflake.

15 Lines of Business Supported

Deploy quickly throughout your organization with out-of-the-box support for 15 commercial and specialty lines of business.

17,000+ Available Data Attributes

Get actionable insights from your data with flexible data structures that support data mining capabilities tailored to insurance.

100+ Insurance Systems Integrated

Leverage a proven system that is designed, developed, and delivered exclusively for P&C insurers.

Why Insurity Data Depot?

Leapfrog competitors

Enable any business user to access and analyze data while maintaining end-to-end governance and security with a modern data platform that gives you a competitive edge.

Gain a single source of truth

Provide instant access to one version of data across all your data assets—whether structured, semi-structured, or unstructured. Support near-limitless workloads without copying or moving data.

Make better, faster decisions

Incorporate new and existing forms of data with unparalleled speed, consistency, and security while storing and accessing any third-party data alongside your own.

Embed real-time insights

Discover insights into the business drivers of risk and exposure while evaluating portfolio performance in real-time so you can make data-driven decisions.

Unparalleled Transformative Horsepower

Insurity Data Depot quickly and accurately transforms data generated by core processing systems and third parties into information that is consolidated, cleansed, and conformed. Our partnership with Snowflake adds unmatched speed, consistency, and security—while our open, nonproprietary platform gives you control of what, how, and when you leverage your data.

Insurity Data Depot Solution Overview

Keep up, compete, and be in control of your data strategy with a modern data platform purpose-built for P&C insurers.

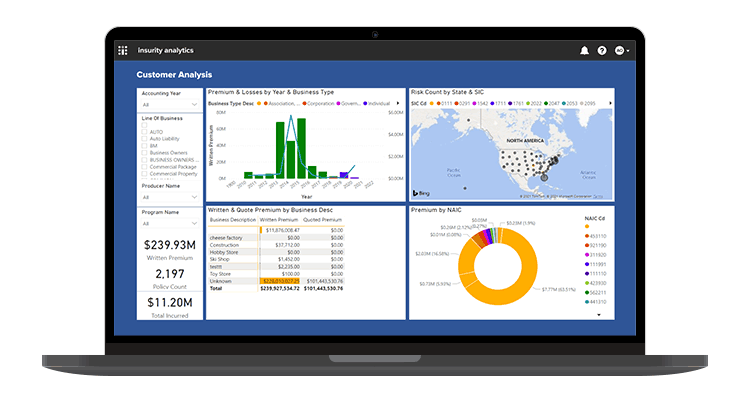

Insurity Analytics Accelerates Data-Driven Decision Making for P&C Carriers

Insurity’s analytics solutions allow insurers to forecast the future and react in real time with AI-powered predictive models.

Insurity Analytics to Enable P&C Insurers to Write More Profitable Policies, Built on Snowflake

Dramatically improve profitability, reduce expenses, and better predict jumper claims with Insurity Analytics, built on Snowflake.

Book a demo