Valen Data Consortium

Boost your predictive power with P&C policy data

With $109 billion in premium across all standard P&C lines of business, the Valen Data Consortium is the largest proprietary database of P&C policy, claims, billing, and submission data combined with over two dozen third-party data sources, adding unparalleled depth and breadth to your data while significantly extending your predictive power.

Billion in Premium

Enhance the power of your models with a deeper view, including $60B in workers’ comp, $8B in commercial auto, and $32B in claims incurred.

Improved Loss Ratio

Improve profitability and lower your cost of claims, as Insurity customers experience 3-10% better loss ratios compared to the industry average.

Average Growth

Drive long-term, profitable growth with AI-powered models, as Insurity customers had 3x the industry average in growth over the past 5 years.

Predictive Power

Add AI-powered predictive analytics to your underwriting and pricing models with consortium-derived predictive variables.

Why Valen Data Consortium?

Get the most detailed and recent data

Policy, claims, and underwriting inputs are standardized and normalized in a robust data warehouse. Regular feeds of consortium policy data provide pre- and post-audit premium and loss data.

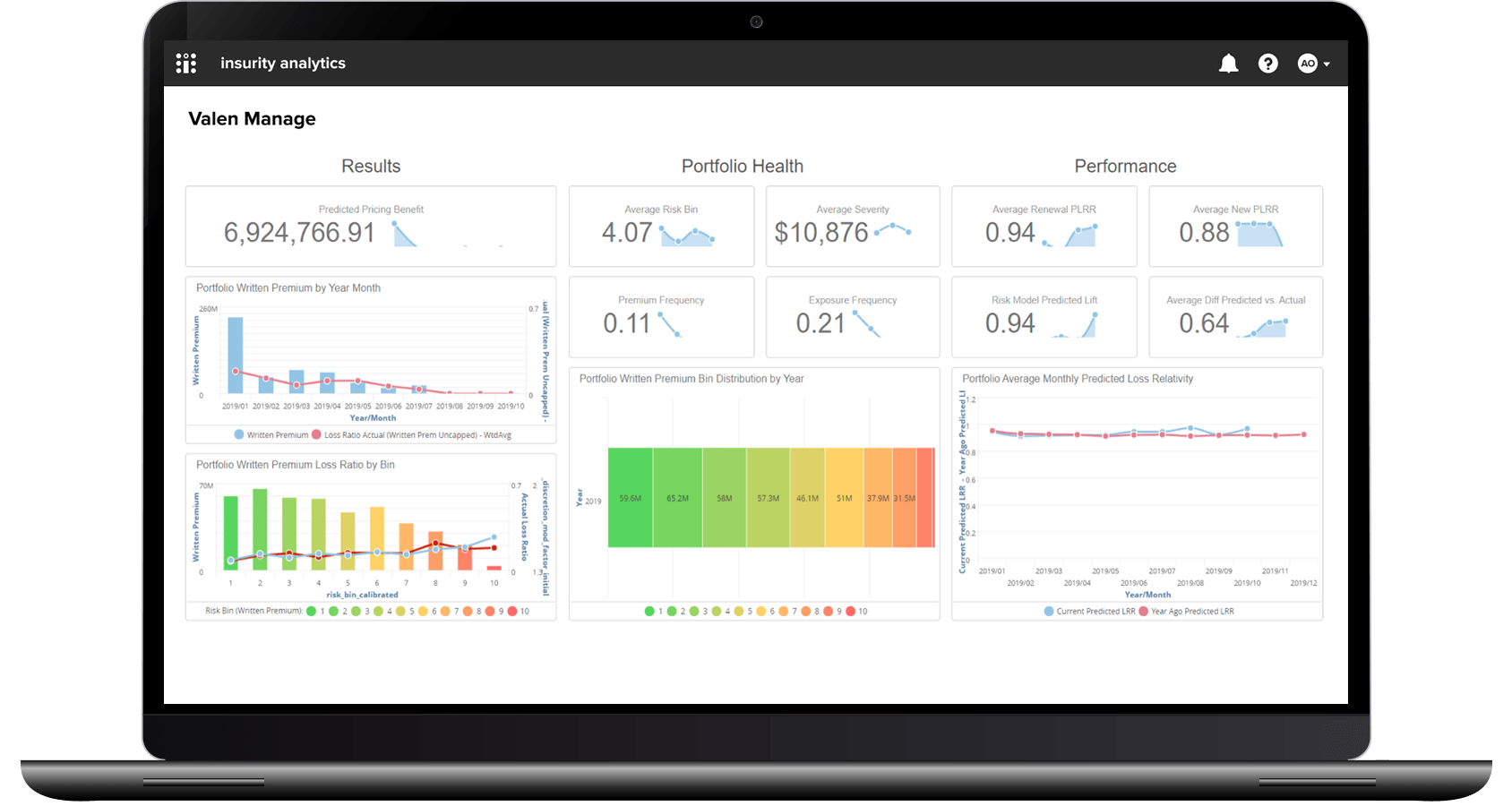

Measure impact on performance

Understand the impact of data-driven decisions on your performance with reports that combine model predictions, underwriter decisions, and actual claim experience to show quantifiable results.

Proactively manage your portfolio

Including policy predictions into portfolio management analytics enables you to take proactive action based on where your performance is headed rather than waiting until losses have been incurred.

Leverage anonymized and cleansed contributions

Insurers that leverage the Valen Data Consortium in their models are contributing members of the consortium. Data contributions to the consortium are completely anonymized, cleansed, and protected.

Resources

Insurity 2021 Analytics Outlook Report - Underwriting Trends and Predictive Analytics

Insurity’s annual underwriting and innovation survey shows that use of predictive analytics is steadily rising among re/insurers, MGAs, and brokers.

Insurity Predict Case Study

Learn how experienced underwriters are leveraging Insurity Predict for more accurate pricing.

Insurity 2021 Analytics Outlook Report

COVID-19 accelerated digital adoption in nearly every industry, forcing new pathways for productivity, distribution, and collaboration—perhaps permanently.

Book a demo