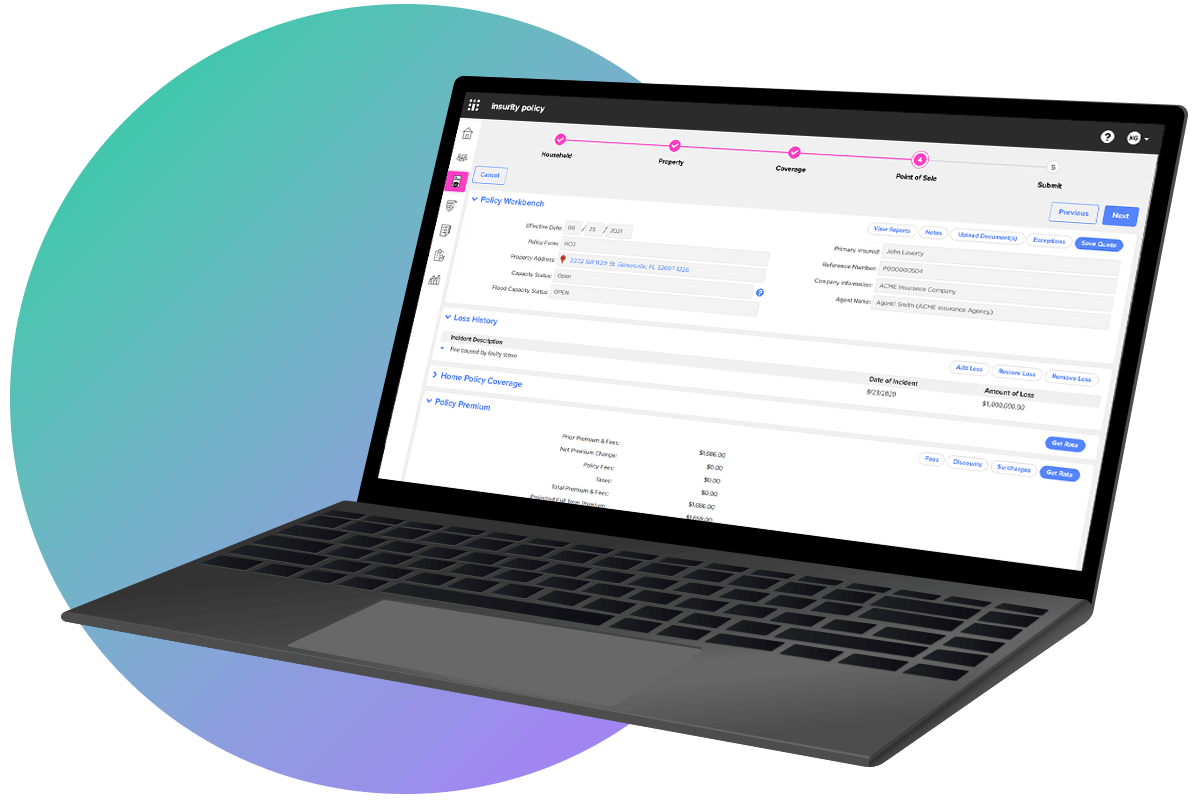

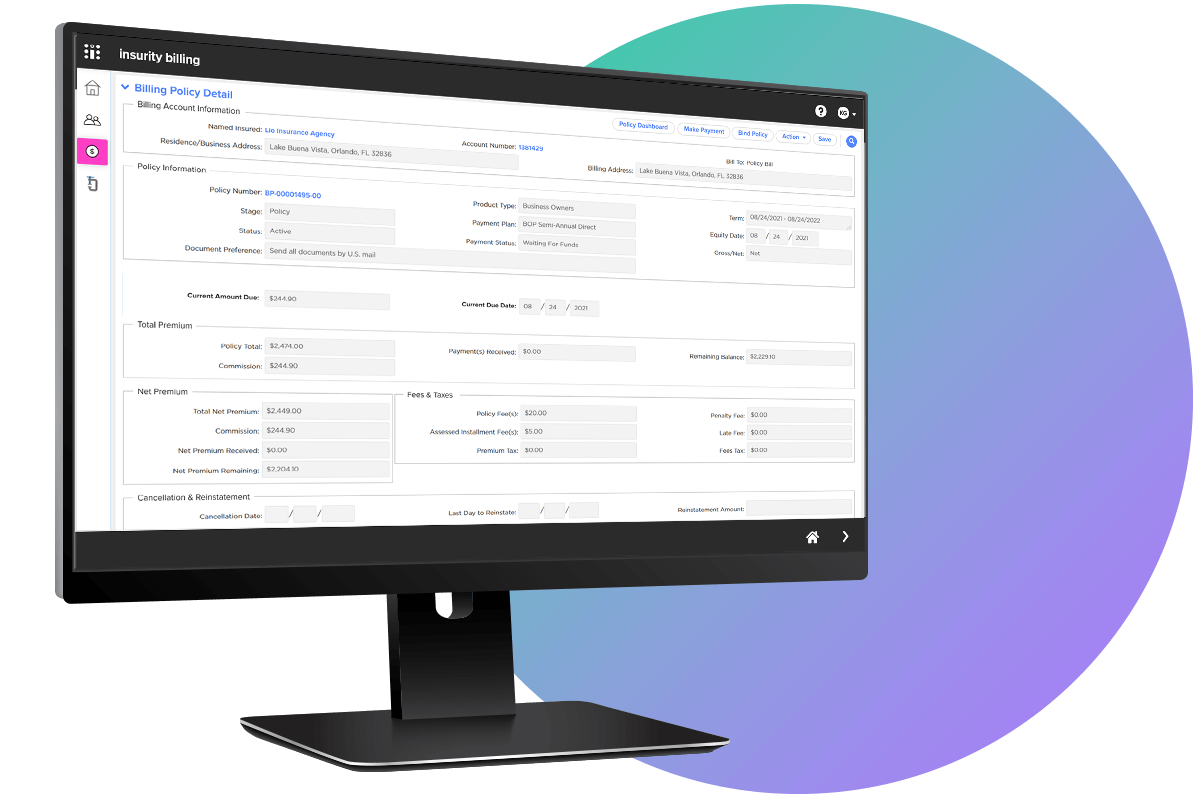

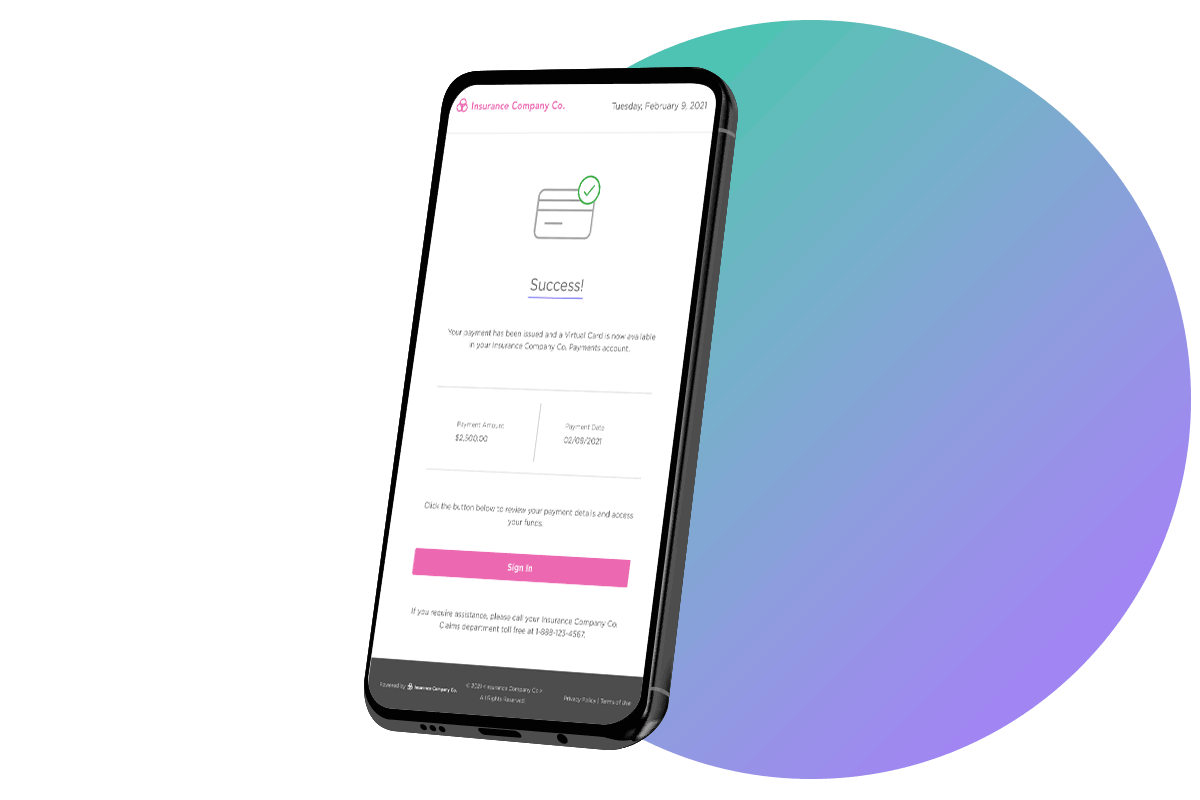

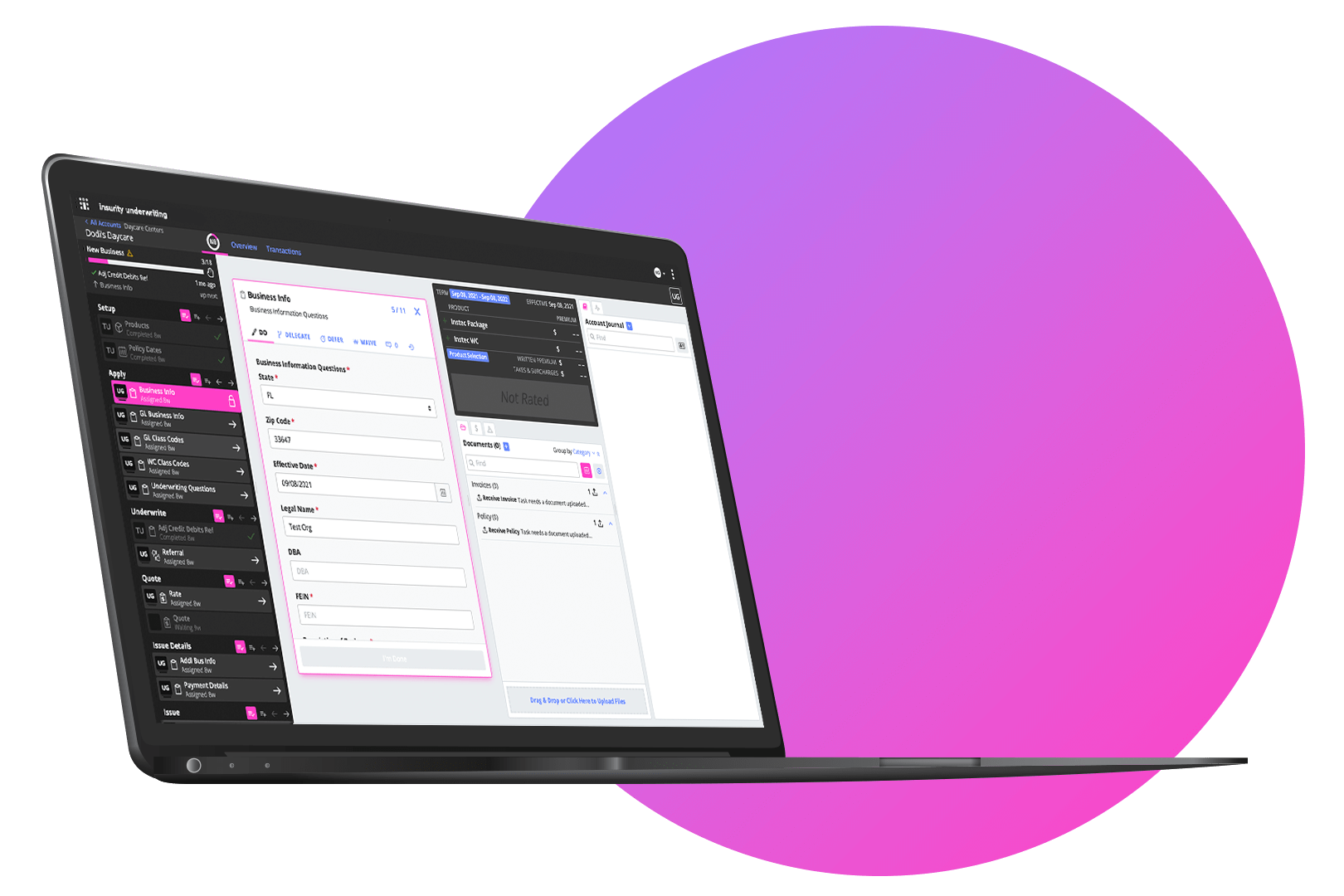

Insurity Platform

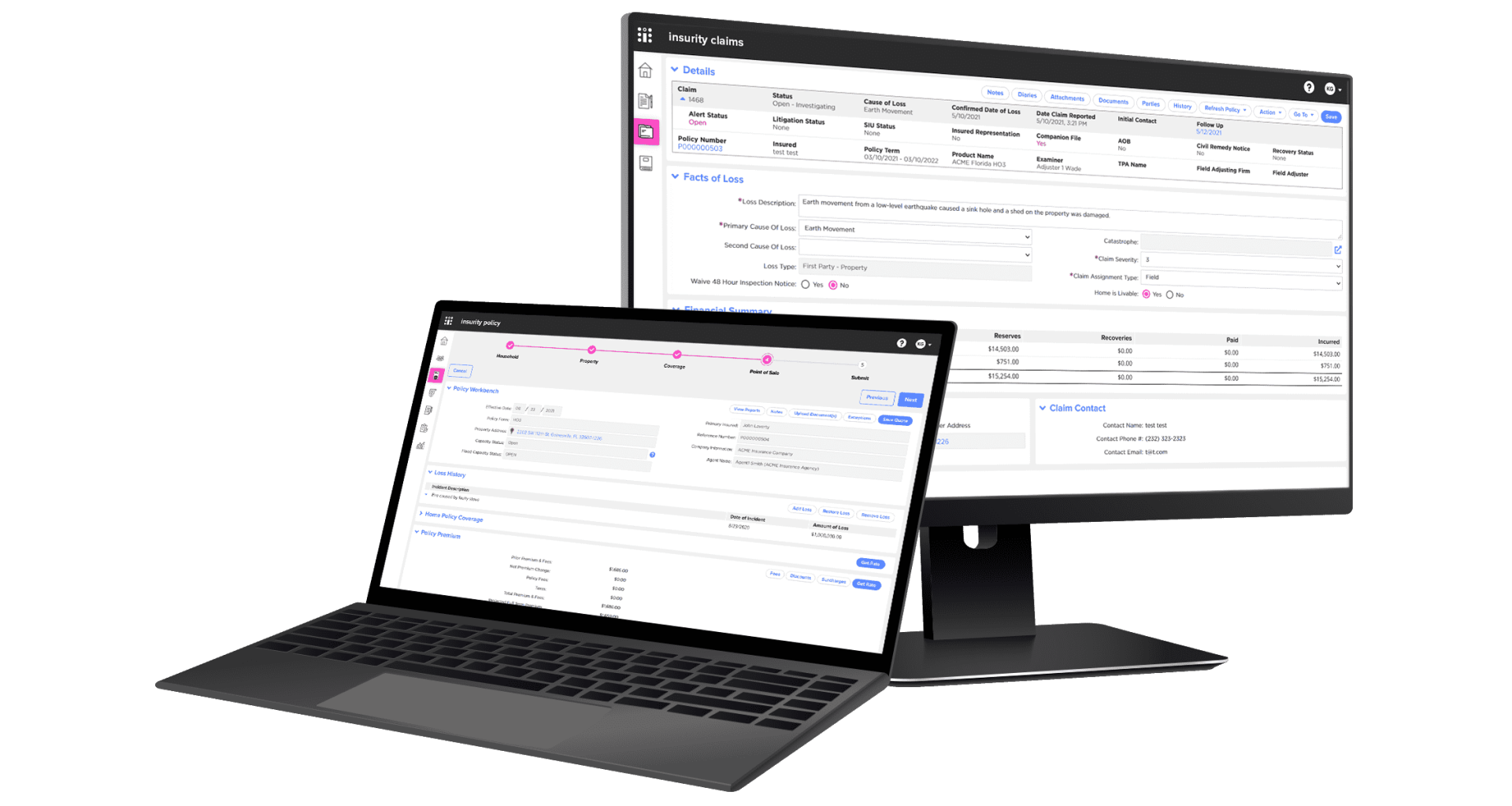

The Insurity Platform empowers more than 500 P&C carriers, MGAs, and brokers to quickly capitalize on new opportunities through a cloud-first, end-to-end system for policy, billing, claims, analytics and more.

500+ Leading Customers

Our proven platform supports many commercial, personal, specialty, and proprietary lines of business, with over $20B in premiums running on Insurity solutions.

20+ Years' Cloud Leadership

Insurity is the largest cloud software provider in P&C insurance, with 400+ of our customers in the cloud and 330+ of those in the public cloud on Azure and AWS.

50+ Successful Annual Go-Lives

In partnership with over 18 system integrator partners, Insurity delivers speed, value, and flexibility to insurers, enabling them to be more profitable and efficient.

How can the Insurity Platform transform your business?

Explore why organizations like Wilmington Insurance Company rely on the Insurity Platform to improve efficiencies and evolve their underwriting and policy admin system.

Our success stories

Insurity is Positioned as a Leader in the Everest Group PEAK Matrix® Assessment

Insurity’s cloud-based solution was recognized with top marks by Everest Group for enabling insurers to stay agile and flexible in a changing market.

Insurity Becomes Largest Cloud Software Vendor Serving 400+ P&C Insurers in the Cloud, Including 330 in AWS and Azure Public Cloud

Insurity provides policy, billing, and claims to 22 of the top 25 P&C carriers and 7 of the top 10 U.S. MGAs and is the largest cloud software provider in P&C insurance.

How Can Your Organization Become More Efficient with the Insurity Platform?

Learn how organizations like Cable Holdings Company maintain high service standards, increase operational efficiency, and achieve faster growth with the Insurity Platform.

What's in the Insurity Platform?

Book a demo